Blog

What “Trump Homes” Means for Affordability: Rent-to-Own Claims, Builder Pushback, and the Rate Risk

What the rent-to-own “Trump Homes” concept isSeveral outlets describe a rent-to-own “pathway-to-ownership” structure in which private investors purchase newly built, entry-level homes and lease them to households. After roughly three years, renters could apply prior monthly payments toward a down payment if they choose to buy the home. Some reporting suggests the concept has been floated at a scale of up to about 1 million homes and more than $250 billion in housing value.

6 min read

February 4th, 2026

Can Mortgage-Rate Relief Lower Payments Without Driving Home Prices Higher?

The core issueA renewed focus on lowering mortgage rates is colliding with a simple housing reality: when inventory is limited, cheaper financing often increases bidding power faster than it increases the number of homes for sale—so prices can rise.

6 min read

February 4th, 2026

Buyer Power Slowly Returns as Regional Price Growth Cools

Why the market is feeling more buyer-friendlyThe most important change for buyers isn’t a nationwide “crash.” It’s that the market is gradually rebalancing: more homes are available relative to a year ago, and listings are sitting longer in many areas. When that happens, sellers compete harder for the marginal buyer, often through price cuts or concessions.

6 min read

February 2nd, 2026

Local Housing Policy Experiments: What’s Working to Add Supply (and What May Raise Prices)

Why ‘local levers’ matter in a supply-constrained market

6 min read

February 1st, 2026

Why ‘Keeping Home Prices High’ Conflicts With Affordability—and What Actually Moves Payments

The core trade-off: equity vs entryOne of the most persistent tensions in U.S. housing is that the same thing that makes current owners feel financially secure—stable or rising home values—often makes it harder for new buyers to enter. When prices rise, homeowner equity grows. But buyers experience affordability through the monthly payment, which is driven by the home price, the mortgage rate, taxes/insurance, and down payment.

7 min read

January 31st, 2026

Why “Keep Prices High, Cut Rates” Keeps Housing Affordability Stuck

The core tension: prices vs. accessA homeowner-first housing message has a clear goal: avoid price declines that would shrink existing owners’ equity, and focus affordability efforts on the monthly payment side of the equation instead. That framing matters because the U.S. housing market doesn’t respond to “affordability” as a single variable — buyers experience it as both sticker price *and* financing cost.

6 min read

January 31st, 2026

Luxury housing stays strong while the rest of the market cools: what the split means in 2026

What the “market split” looks like nowIn much of the country, mainstream housing demand is cooling as monthly payments stay elevated and first-time buyers struggle to qualify. Local reporting in Georgia describes buyers being squeezed by rising prices alongside constraints like investor demand and a worker shortage that can limit how quickly supply responds.

6 min read

January 29th, 2026

Record Homebuyer Deal Cancellations, but Prices Still Rise: What the Data Say Heading Into 2026

The cancellation spike: what changed in DecemberOne of the clearest signs that buyer behavior is shifting is showing up *after* homes go under contract. Redfin’s latest look at MLS-based contract outcomes shows that cancellations surged in December 2025—meaning a larger-than-usual share of accepted offers never made it to closing. In Redfin’s estimate, about 16.3% of December purchase agreements fell through, representing roughly 40,000 canceled transactions, and that share was higher than the prior year’s December level.

6 min read

January 28th, 2026

U.S. Home Prices Pick Up Again—But Regional Divergence Is Now the Main Story

What the latest national indexes showedTwo of the most-followed home-price gauges ended 2025 with the same broad message: prices rose again in November, but the year-over-year pace is far calmer than the recent boom years.

6 min read

January 28th, 2026

Mortgage-rate stimulus vs. supply fixes: what the newest housing-cost proposals could mean

Why affordability is still stuckEven as the market moves through different rate regimes, many households are still boxed out by the same math: monthly payments remain high because both **home prices** and **mortgage rates** have stayed elevated compared with the pre-2022 era. When inventory is limited, even a modest increase in demand can translate into higher prices rather than more transactions.

7 min read

January 26th, 2026

Investor scrutiny on single-family home buying: why build-to-rent may be the near-term winner

What the executive order actually signalsRecent reporting describes an executive order that directs federal agencies to scrutinize the business practices of large-scale owners buying single-family homes at industrial scale. That kind of directive can change behavior even before any new rule is finalized, because it increases compliance risk and raises the cost of capital for large buyers that depend on predictable acquisition pipelines.

6 min read

January 26th, 2026

Home Prices Are Flat in Some Metros—So Why Does Affordability Still Feel Worse?

The market can stabilize without getting affordable

6 min read

January 26th, 2026

Institutional Landlords Face Growing Scrutiny in Single-Family Rentals—What the Data Actually Shows

Why institutional SFR ownership became a flashpoint

7 min read

January 21st, 2026

Rent caps, disclosure mandates, and enforcement: the new front line in U.S. rental housing

What’s changing: rent caps vs. transparency vs. enforcement

7 min read

January 20th, 2026

Algorithmic Rent-Setting Is Under Pressure: What New Settlements and State Bans Mean

What’s changing — and why it mattersAcross U.S. multifamily markets, regulators and courts are increasingly scrutinizing rent-setting software that aggregates landlord data and generates price recommendations. The core concern is not ‘using analytics’ in general, but whether a tool relies on nonpublic, competitively sensitive information shared among competitors and then steers pricing behavior in ways that reduce independent decision-making.

6 min read

January 19th, 2026

Rent rules tighten nationwide: caps, fee limits, and enforcement raise landlord compliance stakes

The story in one lineMore local governments are regulating the mechanics of renting — not only how much rent can rise, but also the fees, notices, and enforcement systems that determine what tenants actually pay and how disputes get resolved.

6 min read

January 17th, 2026

States and cities crack down on illegal rent hikes, rent caps, and fee workarounds

What’s changing: enforcement, not just rulesA growing number of jurisdictions are moving from passing tenant-protection rules to actively enforcing them. The practical shift is that “noncompliant rent growth” is increasingly being treated as an enforceable overcharge—triggering withdrawn notices, refunds, and settlement terms that restrict future pricing behavior.

7 min read

January 16th, 2026

Small and ‘Accidental’ Landlords Are Reshaping U.S. Rental Supply

Why small landlords matter more than headlines suggest

6 min read

January 14th, 2026

Landlords Face a New Squeeze: Cooling Rent Growth Meets Rising Operating and Compliance Costs

What the national rent cooldown looks likeAfter the rapid run-up of 2021–2022, the national rent story has shifted toward stability—sometimes even small declines—depending on which dataset you follow. Apartment List reported that the national median rent fell 0.8% in December and closed 2025 at $1,356, down 1.3% from a year earlier, alongside a record-high multifamily vacancy rate of 7.3% in its index.

7 min read

January 12th, 2026

Algorithmic Rent-Setting Crackdown: What New Bans and Settlements Mean for U.S. Apartment Pricing

What’s changing: from algorithmic recommendations to compliance-first pricing

6 min read

January 11th, 2026

Cooling and Appliance Requirements Are Redefining Rental Habitability Standards

Why “habitability” is getting more specificAcross many U.S. markets, habitability used to be discussed mostly in terms of essentials: water, sanitation, structural safety, and heat. Increasingly, local and state rules are spelling out additional minimum conditions tied to health—especially as extreme heat becomes a more common stress test for older housing stock.

6 min read

January 10th, 2026

Cities escalate enforcement against big landlords: hearings, fines, and rent-setting scrutiny

What’s changing: from complaints to enforcementAcross multiple U.S. cities and states, the posture toward large or high-profile landlords is shifting from reactive complaint handling to more visible enforcement and public accountability. The common threads are familiar—habitability and maintenance problems, disputed fees, and rent increases—but the tools being used now include hearings, formal investigations, and settlements that force business-practice changes.

6 min read

January 8th, 2026

Rent enforcement is escalating: refunds, penalties, and new limits on algorithmic rent-setting

Rent enforcement is shifting from warnings to dollars

7 min read

January 7th, 2026

NYC’s ‘Rental Ripoff’ Hearings: What They Are, What They Can Change, and What to Watch

What the city orderedNew York City is directing multiple agencies to hold “Rental Ripoff” hearings in all five boroughs within 100 days. The hearings are intended to gather testimony from tenants and other stakeholders about alleged illegal, deceptive, or abusive landlord practices, along with operational changes the city could make to strengthen housing and building code enforcement.

7 min read

January 7th, 2026

Rental Fees Are the New Front Line: How Local Rules Are Changing the True Cost of Renting

Why fees matter more than everFor many renters, the advertised rent is no longer the full story. A growing share of the total monthly cost can come from “add-on” charges—everything from admin fees to recurring service fees—making it harder to compare apartments and easier for surprise costs to appear after move-in.

6 min read

January 5th, 2026

How New Rent Control And Rent Cap Reforms Are Reshaping Local Rental Markets

A new phase of rent regulation is hereAfter a decade of rising rents, more U.S. cities and states are tightening the rules on how fast landlords can raise rents. Instead of one big national policy, a patchwork of local rent caps, rent stabilization updates and enforcement efforts is emerging — and it is starting to change how both tenants and owners plan for the future.

8 min read

January 4th, 2026

Rents Are Outpacing Inflation While Landlords Say They’re Squeezed: What’s Really Going On?

Rent growth vs. inflation: what the latest data shows

7 min read

January 4th, 2026

How Regulators Are Cracking Down on Rent Price Fixing Beyond Algorithms

From software controversy to a broader rent-fixing crackdown

8 min read

January 2nd, 2026

How New City Rules on Short Term Rentals Could Reshape Local Housing Markets

Why cities are rethinking short term rentalsOver the past decade, short term rentals have gone from a niche side hustle to a mainstream housing use in many U.S. cities. In some tourist-heavy neighborhoods, a meaningful share of apartments and condos now cycle through visitors rather than local renters. Local officials, housing advocates, and neighbors are asking how that shift interacts with already-tight housing markets.

8 min read

January 2nd, 2026

How Rental Inspection Mandates and Registries Are Reshaping U.S. Landlord–Tenant Rules

A quiet but consequential shift in rental oversight

8 min read

December 31st, 2025

How New Cooling Mandates and Habitability Rules Are Rewriting Rental Landlord Obligations

From basic shelter to health-focused housing standards

9 min read

December 31st, 2025

Inside DC’s RENTAL Act: How a sweeping eviction and rent-debt overhaul could reshape the rental market

Why DC’s RENTAL Act is on the table nowWashington, D.C. has long had some of the strongest tenant protections in the country, but the pandemic stress-tested that system. Eviction moratoriums paused formal filings, yet rent still went unpaid and disputes piled up. As those temporary measures wound down, the city saw a surge of cases alongside a backlog of rental debt, especially in older multifamily stock owned by small landlords. WJLA’s investigative reporting chronicles owners who say they are carrying many months of arrears with limited tools to resolve nonpayment or chronic lease violations.

8 min read

December 29th, 2025

How NYC’s New Broker-Fee Rules Could Reshape Rents, Leasing, and Affordability

What NYC’s new broker-fee rules actually doIn many U.S. cities, especially New York, renters have long been expected to pay a hefty broker fee – often 12–15% of the annual rent – even when they never chose the agent. Recent reforms flip that script by tying the fee to the party who actually hires the broker. In New York City, the Fairness in Apartment Rentals Act generally requires landlords to pay the commission for agents they hire to lease their units, instead of passing that bill to tenants.

7 min read

December 28th, 2025

Local Rent Control Is Entering a New Phase: Tighter Caps, Tougher Enforcement, and Bans on Rent Algorithms

A new wave of local rent limitsAcross the country, local officials are testing how far they can go to slow rent growth without freezing new investment. Instead of classic 1970s-style rent freezes, today’s debate is about caps on annual increases, enforcement of those caps, and new guardrails on how landlords set prices in the first place.

8 min read

December 27th, 2025

How LA’s New 82°F Cooling Mandates Could Rewrite Rental Housing Standards

A new kind of habitability rule: maximum indoor temperature

8 min read

December 26th, 2025

Rents Keep Climbing While Landlords Say They’re Squeezed: What’s Really Happening in the U.S. Rental Market?

Rents Are Still Rising Faster Than InflationNationally, asking rents have cooled from the double‑digit spikes seen during the pandemic, but they are still growing faster than overall consumer prices. NerdWallet notes that recent consumer price index data shows rent inflation running ahead of headline inflation, meaning housing costs continue to eat a bigger share of household budgets even as other items stabilize or fall.

9 min read

December 25th, 2025

How New Rules On Deposits, Fees, and Evictions Are Rebalancing U.S. Rentals

Why deposits and fees are under scrutiny nowSecurity deposits and rental fees have always been part of the cost of housing, but they’ve become flash points as rent burdens climb and more renters struggle with move-in costs. A Newsweek story about a Houston landlord returning a full deposit after a clean move-out highlights a common frustration: she says that in five years as a renter she never once received any portion of her own deposits back, despite not damaging her units.

10 min read

December 25th, 2025

Regulators Escalate Crackdown on Alleged Landlord Rent Collusion, With and Without Algorithms

A nationwide wave of rent‑collusion enforcementOver the past year, a growing list of state and local enforcement agencies has turned its attention to alleged rent collusion among large landlords. The early headlines focused on RealPage, a major provider of revenue management software for apartment operators, but recent cases make clear that regulators are just as interested in the conduct of landlords themselves.

7 min read

December 23rd, 2025

How New Rent Caps, Fee Limits, and Pricing Rules Are Reshaping Life for Small Landlords

A new wave of local rules aimed at rents and feesAcross the country, cities and states are rewriting the rules of the rental market. New proposals and laws target not just how much landlords can raise rent, but also late fees, add-on charges, broker commissions, and even the software used to set prices. Small landlords, who often rely on a handful of units for income and have limited access to cheap capital, say they feel these shifts most acutely.

10 min read

December 22nd, 2025

How Crackdowns on Rent Algorithms Are Reshaping Multifamily Pricing for Big Landlords

From revenue management to alleged rent cartelsOver the past decade, algorithmic pricing tools promised to bring airline-style revenue management to apartment rents. Products like RealPage’s YieldStar and related services used large datasets, including detailed property-level performance, to recommend daily rent levels for individual units. For many institutional owners, this seemed like a way to optimize revenue, reduce vacancies, and take emotion out of pricing.

7 min read

December 21st, 2025

How Local Rent Relief and Disaster Programs Are Propping Up Small Landlords and Tenants

Why small rentals are so vulnerable in disasters and funding shocks

8 min read

December 20th, 2025

How New Health and Safety Standards Are Raising Operating Costs for Landlords

The new wave of rental habitability standardsAcross the country, local and state agencies are quietly tightening health and safety standards for rental housing. The broad goal is to ensure that tenants have access to basic appliances, safe indoor temperatures and protection from known hazards like lead paint – but those upgrades come with real costs for property owners.

8 min read

December 20th, 2025

How Local Landlord Registries and Inspection Mandates Are Reshaping U.S. Rentals

A quiet but widespread shift in local rental regulation

8 min read

December 20th, 2025

How Local Incentives Are Pulling Landlords Into Rental Code Compliance

Why cities are rethinking rental code enforcementLocal housing officials are under pressure to improve rental conditions without shrinking already tight housing supply. After years of relying heavily on fines and threats, many are experimenting with a more balanced mix of enforcement plus incentives aimed at keeping units online. [#3][#4]

7 min read

December 16th, 2025

Why Landlords Feel Squeezed Even as U.S. Rents Keep Climbing

Rent growth vs. inflation: the headline numbersRecent federal data continue to show rent and shelter costs running hotter than overall inflation. NerdWallet reports that in the 12 months ending in September, rent in the consumer price index rose 3.5%, just below the broader shelter index at 3.6% and still above the overall inflation rate.

8 min read

December 15th, 2025

State Attorneys General Are Redrawing the Lines on Rent Hikes and Algorithmic Pricing

A wave of enforcement actions hits large landlordsOver the last year, a series of high-profile cases in North Carolina, Oregon, Washington, and the District of Columbia has pushed landlord conduct—and especially rent-setting practices—under a brighter spotlight. Complaints that once focused on individual bad actors are now aimed at some of the largest property managers in the country and the software they use to set prices.

8 min read

December 14th, 2025

How Accidental Landlords and Wall Street Investors Are Rewriting the U.S. Rental Market

What is an “accidental landlord”?In 2025, more U.S. homeowners are finding themselves renting out properties they never bought as investments. These “accidental landlords” might have outgrown a starter home, moved for work, or combined households — but instead of selling, they list the old place for rent.

7 min read

December 12th, 2025

From Heat Waves To Habitability: How Cities Are Tightening Cooling Rules And Rental Inspections

Why heat and health are reshaping rental codesCities are starting to treat safe indoor temperatures and basic maintenance as core parts of habitability, not extras. That shift is especially visible in hotter metros, where extreme heat is now one of the main weather-related causes of death, and in older housing markets where long-deferred repairs have become a public health issue.

7 min read

December 11th, 2025

How New Local Rental Rules Are Reshaping the Landlord–Tenant Balance Across U.S. Cities

A New Wave of Local Rental RegulationLocal rental rules are tightening across the U.S., and the changes are arriving not as one national overhaul but as a patchwork of city and state actions. From small cities in West Virginia and Michigan to major metros in California and Washington, local officials are writing new standards around safety, rent increases, fees, and landlord accountability.

9 min read

December 11th, 2025

How New Tenant Protection Laws Are Reshaping U.S. Rental Housing

A fragmented but fast-moving wave of tenant protections

8 min read

December 10th, 2025

Investors Now Buy Nearly One in Three U.S. Homes: What It Means for Prices, Renters, and First-Time Buyers

How big is today’s investor footprint?According to new data from real estate analytics firm Cotality, investors accounted for roughly 29% of U.S. single-family home purchases in June 2025, down from a high of 32% in January but still well above the 25% share recorded a year earlier. In practical terms, investors have been buying about 85,000 homes per month so far this year, nearly identical to their pace in the first half of 2024.

7 min read

December 9th, 2025

When Rent Eats Everything: How Extreme Renter Cost Burdens Are Undermining US Household Finances

A new way to measure rent stress: what's left after the bills

7 min read

December 7th, 2025

How Short-Term Rental Management Firms Are Reshaping Hosting Across U.S. Markets

From hobby hosts to professional operationsIn many U.S. cities, the short-term rental market has shifted from casual, do-it-yourself hosting to a more professional, service-driven model. Short-term rental management companies now pitch a simple value proposition to owners: they handle the work, the owner collects a share of the revenue. Business Upturn notes that these firms have gained traction as more homeowners explore holiday and business stays and look for convenience and streamlined processes.

5 min read

December 5th, 2025

Greystar’s $24 Million Junk-Fee Settlement: What It Means for U.S. Renters and Landlords

What the Greystar settlement is aboutFederal regulators recently announced a proposed settlement with Greystar, one of the largest apartment managers in the United States, resolving allegations that the company used deceptive advertising practices in how it marketed rents. The $24 million deal, which still requires court approval, stems from claims that Greystar advertised attractively low base rents while adding mandatory monthly charges that were not clearly disclosed up front.

7 min read

December 4th, 2025

2026 Housing Outlook: Why At Least 22 U.S. Cities May See Home Prices Fall Even as the Nation Edges Higher

National 2026 housing baseline: a slow thaw, not a boom

7 min read

December 4th, 2025

How Wall Street’s Push Into Single-Family Rentals Is Reshaping Long-Term Renting in America

From owner nation to renter growth storyFor decades, U.S. housing has been described as a nation of owners. Yet the past quarter-century tells a more nuanced story: the rental side of the market has grown substantially even while the overall homeownership rate has stayed relatively stable.

8 min read

December 2nd, 2025

Long-Term Renting Is Reshaping U.S. Housing: Affordability, Investors and the New Normal

Affordability squeeze and the rise of long-term renting

7 min read

December 1st, 2025

2026 U.S. Housing Market Forecast: Stable Mortgage Rates, Slower Price Growth and Stubborn Costs

A 2026 housing market that’s calmer—but not cheapAfter several years of whiplash in mortgage rates and home prices, many early forecasts suggest the U.S. housing market in 2026 will look more stable, even if it remains expensive. A key theme across outlooks is that borrowing costs settle into a narrower band while home prices keep rising at a slower, more historically normal pace.

7 min read

November 30th, 2025

Oops, We Slept Through Black Friday… Enjoy 50% Off Anyway!

We may have slept through Black Friday — but your 50% discount is wide awake

1 min

November 29th, 2025

Why All-Cash Buyers Now Dominate New York City Home Sales — And What It Means for Affordability

Cash takes over the NYC housing marketIn New York City’s current housing cycle, cash really is king. A new report from the Center for NYC Neighborhoods, highlighted by Gothamist, finds that more than 60% of the 17,924 home sales recorded in the five boroughs during the first half of 2025 were all-cash purchases. That means the buyer paid the entire price upfront, with no mortgage recorded on the transaction.

6 min read

November 29th, 2025

Santa Fe’s New Minimum Wage Formula: Linking Paychecks to Local Rents

Santa Fe’s affordability squeezeSanta Fe has long branded itself “The City Different,” with a distinctive mix of cultures and a strong tourism and arts economy. But like many destination markets, its popularity has come with a cost: housing prices and rents that have climbed far faster than many local paychecks. City officials describe an affordability crisis in which workers who staff restaurants, hotels, construction sites, and service jobs increasingly struggle to live in the same community where they work.

7 min read

November 28th, 2025

VA Home Loans: The Underused Zero‑Down Benefit That Helps Veterans Buy Years Sooner

How VA Loans Work and Who QualifiesThe VA home loan program is designed to help eligible U.S. veterans, active‑duty service members, and some surviving spouses buy homes with more flexible terms than most conventional mortgages. The most distinctive feature is the ability to finance up to 100% of the purchase price, meaning no down payment is required in many cases.

7 min read

November 28th, 2025

How Fed Rate Cuts and Cheaper Mortgage Costs Are Slowly Thawing the U.S. Housing Market

From rate hikes to rate cuts: why housing finance is finally easing

7 min read

November 28th, 2025

50-Year Mortgages in the U.S.: Lower Payments Today, Bigger Risks Tomorrow

Why 50-year mortgages are on the tableThe renewed talk of 50-year mortgages is a direct response to the affordability squeeze in U.S. housing. The AOL analysis notes that the average first-time buyer is now around 40 years old, a record high, while the median existing-home price recently climbed above $435,000 — more than 50% higher than in early 2020. Mortgage rates have hovered above 6% for several years, and typical households are spending close to 40% of their income on housing costs.

7 min read

November 28th, 2025

How Creative Financing and Hybrid Short‑Term Rental Loans Are Changing the Game for Small US Investors

Why small investors are turning to creative financing

7 min read

November 28th, 2025

Refinance Wave Builds as Mortgage Rates Fall: What It Means for Homeowners and the Housing Market

From 7%+ to the Low‑6s: How Far Mortgage Rates Have Fallen

7 min read

November 23rd, 2025

Portable Mortgages in the U.S.: How Taking Your Rate With You Could Reshape Housing

What are portable mortgages and why are they being studied?

7 min read

November 22nd, 2025

How Corporate and Institutional Investors Are Reshaping Local Homeownership in U.S. Markets

From "city of homeowners" to investor hot spotPhiladelphia has long marketed itself as a city where owning a rowhouse is part of the local identity. Yet between 2006 and 2025, the city’s homeownership rate slipped from about 58% to roughly 52%, according to a recent State of the City analysis cited by The Philadelphia Citizen. During that same period, investors steadily increased their presence in the single‑family and small‑multifamily market.

7 min read

November 21st, 2025

How Soaring Home Insurance Costs Are Quietly Reshaping the U.S. Housing Market

From footnote to headline cost in the monthly payment

8 min read

November 21st, 2025

The Crackdown on Rent-Setting Software: How New Rules Could Reshape U.S. Rents

What rent-setting software does and why it spreadOver the past decade, algorithmic rent-setting tools have become standard for many large apartment operators. These services, offered by companies such as RealPage, pull in vast amounts of lease data from subscribing landlords—current asking rents, signed lease terms, vacancy levels, renewal behavior, and concessions. They then generate daily recommendations for each unit or floor plan, telling managers whether to push rents higher, hold steady, or discount to fill vacancies.

7 min read

November 20th, 2025

How Older Repeat Buyers Are Quietly Reshaping U.S. Homeownership

The graying of the American homebuyerIn just one generation, the profile of the “typical” U.S. homebuyer has shifted sharply older. According to the National Association of Realtors’ latest Profile of Home Buyers and Sellers, the median age of first-time buyers reached a record 40 in 2024, while the median age for all buyers climbed to 59.

8 min read

November 18th, 2025

The Real Cost of Owning a Home in 2025: Hidden Expenses Now Near $16,000 a Year

Homebuyers often run the math on principal and interest—and stop there. But in 2025, the “other” line items are the bigger surprise. A new analysis from Zillow and Thumbtack puts the average nonmortgage costs of owning a home—maintenance, homeowners insurance, and property taxes—at $15,979 per year, about $1,325 a month on top of the mortgage. Those costs rose 4.7% over the past year while household incomes increased 3.8%, widening the affordability gap.

6 min read

November 17th, 2025

Mortgage Lock‑In: Why Homeowners Aren’t Moving—and How It’s Freezing Supply

Mortgage rate lock‑in isn’t just a headline—it’s quantifiable and it’s reshaping U.S. housing. Federal Reserve researchers link the 2021–22 mobility decline directly to the widening gap between today’s mortgage rates and the ultra‑low loans many owners hold. Their working paper estimates mortgage rate lock‑in explains 44% of the drop in borrower mobility in that period.

6 min read

November 17th, 2025

Affordability Squeeze Is Reshaping U.S. Housing: Price Cuts, Delistings, and a Shift to Cheaper Metros

Affordability is still the headwindThe headline 30‑year fixed rate has steadied in the low‑6s—6.24% as of November 13, 2025—near this year’s lows. That relief matters, but the typical payment remains far above pre‑pandemic norms, which is why behavior across the market is changing even with modestly lower rates. A separate cut of data shows the typical mortgage payment has more than doubled since 2019, underscoring why demand remains selective.

6 min read

November 16th, 2025

50-Year Mortgages in the U.S.: What They’d Really Do to Payments, Prices, and Risk

What’s being proposed — and why nowPresident Trump signaled interest in creating a new 50-year mortgage, and FHFA Director Bill Pulte amplified the idea as a potential “game changer.” The stated intent is to trim monthly payments and broaden access for younger buyers. Industry reaction has been mixed to skeptical, with allies and critics alike warning that the savings may be modest and the long-run costs high.

6 min read

November 15th, 2025

Are Investors Really Buying One-Third of U.S. Homes? The 2025 Housing Investor Boom, Explained

Headline numbers paint a striking picture: depending on who you ask, investors accounted for roughly one‑third of U.S. home purchases at mid‑year 2025—or closer to one in ten. BatchData’s Q2 Investor Pulse report put the investor share at 33% of single‑family purchases in Q2 2025, while Cotality reported investor share running about 29%–32% from January to June. Realtor.com’s Midyear Update, by contrast, measured investors at 10.8% of Q2 transactions, with small buyers representing the majority of activity.

6 min read

November 14th, 2025

Low-6% Mortgage Rates Bring Refi Revival and Builder Buydowns—While 50-Year Loans Loom as a Debate

Where mortgage rates stand nowThe U.S. 30‑year fixed rate averaged 6.22% in the latest weekly Freddie Mac Primary Mortgage Market Survey (PMMS) for Nov. 6, 2025—the lowest zone in roughly a year. The 15‑year averaged 5.50%. Daily trackers are similar, with Zillow’s rate sheet showing a 30‑year fixed near 5.99% and a 15‑year near 5.38% as of Nov. 12–13, reflecting live-market quotes that can move faster than the weekly survey.

5 min read

November 13th, 2025

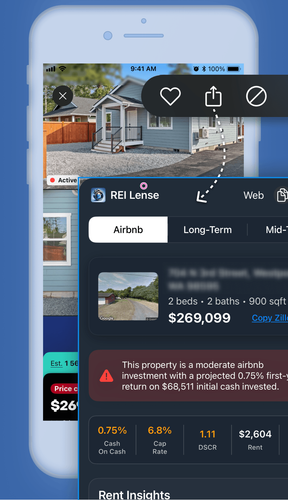

REI Lense for iOS — See Investment Metrics Inside Your Favorite Real-Estate Apps: Zillow, Redfin, Realtor, and Maps!

Why We Built the AppReal estate investors don’t have time to waste. When you’re on the go, switching between apps or juggling spreadsheets breaks your flow. That’s why we built the REI Lense mobile app — designed to leverage your phone’s native power and deliver instant investment insights right where you need them.

2 min

October 1st, 2025

REI Lense iOS App: Full Property Analysis Now Just One Tap Away

Investing in real estate requires clarity. Numbers matter, and the right tools can turn a risky guess into a confident decision. That’s why we’re expanding REI Lense - now not only in the web version but also in a new iOS mobile app, coming soon to the App Store.

2 min

August 27th, 2025

Passive Income Through Real Estate – Myth Or Reality

Ask ten people what “passive income” means, and at least half will paint you the same picture: checks rolling in while they sip coffee on a porch or travel the world. Real estate often tops the list of vehicles for achieving that dream. But in 2025, when interest rates are still high, housing inventory is tight, and tenants are more informed (and demanding) than ever, is “passive” income from property a reality – or just clever marketing?

9-10 min

August 20th, 2025

10 Upgrades That Boost Rental Value Without Breaking the Bank

In today’s rental market, tenants are more selective than ever. A fresh, functional, and well-maintained unit isn’t just a bonus — it’s expected. But here’s the good news: increasing the value of your rental property doesn’t have to cost a fortune. You don’t need to gut the kitchen or knock down walls to boost appeal.

9-10 min

August 13th, 2025

The 1% Rule, 50% Rule, and Why Real Estate Investing Metrics Are Not One-Size-Fits-All

If you've spent any time in real estate investing forums or meetups, you've probably heard the same handful of "rules" tossed around like seasoned advice from a grizzled veteran. The 1% Rule. The 50% Rule. The 70% Rule. They sound smart. They feel actionable. And at first glance, they seem like a great way to shortcut a complicated decision.

6-7 min

August 6th, 2025

How Rental Property Taxes Shape Your Investment Returns

Owning rental property is one of the most reliable ways to build wealth over time. A steady stream of rental income, long-term appreciation, and the ability to leverage financing have made real estate a cornerstone of countless investment portfolios. But what often gets less attention – especially among newer investors – is how taxes can influence your bottom line.

6-7 min

July 14th, 2025

What Are Units in Multi-Family Properties?

If you’re researching rental properties or browsing real estate listings, you’ve probably seen descriptions like “multi-unit property” or references to the number of units in a building. But what exactly does “unit” mean, and why should you care as an investor?

3 min

July 30th, 2025

How to Find Off-Market Properties Faster Than Your Competition

When it comes to real estate, some of the best properties aren’t always visible. These are called off-market properties, and these buildings or lots aren’t advertised on Zillow or posted on a Multiple Listing Service (MLS). Instead, they’re sold quietly through personal networks, direct communication with the owner, or investment companies.

13-15 min

July 23rd, 2025

Key Metrics for Real Estate Investing

Wading through every line item on a rental property pro forma can leave you overwhelmed by detail and blind to what really matters. Seasoned investors instead zero in on six foundational metrics that together paint a complete picture: Annual Revenue, Net Operating Income (NOI), Cash Flow, Cash-on-Cash Return, Capitalization Rate (Cap Rate) and Debt Service Coverage Ratio (DSCR). Below, each metric receives a thorough, practical treatment.

8-9 min

June 13th, 2025

What Does a Real Estate Agent Do?

Buying or selling a piece of property can be an exciting but also stressful experience, as it marks a transition. Whether you are buying or selling, the path always seems to have a couple of loops that make the entire experience stressful. There’s paperwork to handle, appraisals to go through, inspections and negotiations, and a lot more.

13-15 min

July 10th, 2025

DTI Holding You Back? How DSCR Helps Real Estate Investors Get Approved

You find what looks like the perfect rental property, crunch the numbers, secure initial financing - and then your lender hits the brakes: “Sorry, your debt-to-income ratio is too high.” In most residential and investment lending, banks do look closely at DTI (Debt-to-Income Ratio) to ensure your personal income comfortably covers all your debts, including new mortgages.

6-7 min

June 11th, 2025

How to Raise Rent Without Losing Tenants

As a landlord, now and again, you may be required to increase the rent. Property taxes may go higher, maintenance costs also increase, and inflation makes it difficult for you to get any profit out of your investment. That said, there is also the fear that if you raise the rent, you will lose tenants. This might be bad for you in this competitive market, where turnover can be time-consuming and costly.

10-12 min

July 4th, 2025

The Impact of Remote Work on the Real Estate Market

Remote work became quite popular in 2020 when the pandemic pushed everyone to work from home. People enjoyed the flexibility of working from anywhere, which changed rental and home purchase patterns everywhere. Even in 2023, about did some or all of their work remotely, only occasionally coming into the office.

10-12 min

June 25th, 2025

How Interest Rates Affect the Housing Market

Nowadays, everyone is watching interest rates in light of the economic changes. It makes sense because interest rates affect things such as inflation, savings returns, mortgage rates, borrowing costs, and many more. For someone interested in real estate, this could influence their decision to invest in a certain property.

13-15 min

June 18th, 2025

Fix-and-Flip vs. Rental Property: How to Choose the Right Real Estate Strategy for You

As a real estate investor, especially a beginner, you may be faced with the question: should you fix and flip a house, or should you give it out for rent? This can be a difficult decision to make but rest assured: you’re not alone. Both have their systems and benefits, and it’s up to you to determine which one works best.

12-14 min

June 4th, 2025

13 Key Tips for Being a Successful Landlord

Being a landlord is more than just investing in property, giving the tenants the key, and collecting the rent every month. If you want to be successful, then you must ensure your tenants are satisfied. Otherwise, you'll end up driving the tenants away, leading to high vacancy rates and turnover costs.

10-12 min

May 28th, 2025

Long-Term Rentals Strategy in Real Estate Investment

Rental property investment has seen a surge in popularity nowadays. An average of can’t afford to buy a home in the current market, which gives them only one solution: to rent. This is why the U.S. had an average of occupied by renters.

12-14 min

May 21st, 2025

New in REI Lense: Proceeds Calculator, STR Rent Confidence Score, Market Score, and Custom Presets

Selling a home isn’t just about finding a buyer — it’s about understanding the numbers behind the deal. Whether you're a homeowner preparing for a move, a real estate agent guiding clients, or an investor managing your next exit, one question matters most:

3-4 min

May 14th, 2025

Common Rental Scams: How Landlords Can Spot and Avoid Them

Imagine investing in a property that you plan on leasing out. You come across a tenant who seems nice enough, you get your deposit check, and everything seems good. Next thing you know, the check bounces or the next payments are just “crumbs.”

10-12 min

May 7th, 2025

How to Market Your Home for Rent

We live in a highly competitive rental market. It’s no longer enough to just have and lease it out. You need to market it effectively. Otherwise, you could end up with longer vacancies, bad tenants, and low rent prices.

9-11 min

April 30th, 2025

What Are Short-Term Rentals?

Short-term rentals (STRs) are furnished properties that can be rented out for brief stays, ranging anywhere between 1 and 30 days. The final timeline depends on local laws. The IRS defines them as “properties rented out for less than 15 days per year,” at which point you don’t have to report rental income.

12 min

April 23rd, 2025

Your Shortcut to Smarter Real Estate Investing – Now 25% Off

Making confident real estate decisions shouldn’t take hours of manual calculations or outdated tools. With REI Lense Pro, you can analyze properties in minutes – faster, easier, and more accurately.

2 min

April 9th, 2025

Why Smart Investors Are Making the Switch to REI Lense Pro

Investing in real estate requires making data-driven decisions, but traditional deal analysis methods can be slow, complicated, and unreliable. Manual spreadsheets, outdated formulas, and inconsistent data sources often lead to missed opportunities and costly mistakes.

2 min

April 2nd, 2025